It is not easy to manage your finances, isn’t it? We may face job loss or short of money due to many other reasons. To avoid such situations, planning your finances can help you save money for crucial times in life. Also, planning your finances can help you prevent impulse buying or temptations to purchase things that you do not need.

A personal finance management appcan help you manage your funds hence they are in demand just like many other apps that make your life easier. These apps make sure the users get better control over money management using the technology.

So, if you are planning to enter financial technology then personal finance apps can be the best thing to go with.

So, read on to know about how to develop a personal finance app to earn profits. Before we dive into the personal finance app developmentprocess let us understand more about financial apps.

Personal Finance App - What Is The App All About?

A personal finance app is a tech solution that is linked to your bank account and sends data related to your spending and earnings. It also helps you know about your spending patterns, money management behavior and suggests the best possible methods to spend your earnings to meet your financial goals.

Certainly, financial apps can have few or varied functions to meet the individual needs to resolve the financial management issues.

These apps are also called money management or budgeting apps and these mobile apps synchronize your bank, credit cards, and investment accounts in one place.

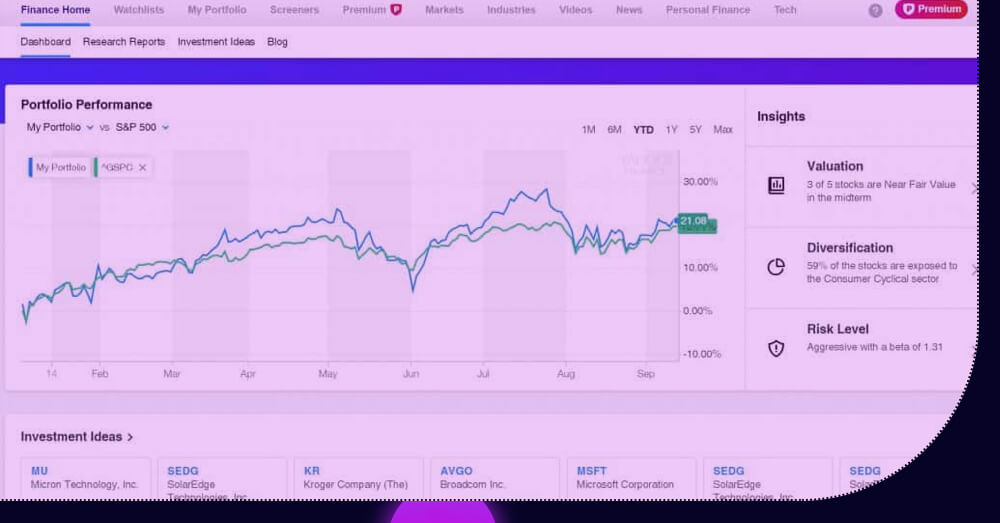

- These apps also keep track of your expenses and assess them through visual representations like charts and graphs.

- Replace the traditional methods of bookkeeping to manage funds.

Why Do People Utilize Personal Finance Apps?

Today, most people use personal finance apps on their phones as the apps:

- Offer easy finance management

- Get complete control over your spending and track them easily

- Help you save money and plan your future better

- Help you prepare for emergencies related to finances and also come out of credit liability.

- Focus on timely payment of taxes

What Are The Different Types of Finance Apps?

You will find a range of financial management apps, but the two main types are

- Simple Apps – It needs data entry to be performed manually

- Complex services – It automates the data entry process

Benefits of Simple Finance Apps

It is an easy money management app wherein the user can feed the expenditure details on his own manually. The apps help track the expenses and arrange them in different categories and plan big purchases.

- Offer high security as the app doesn’t have any of your bank cards linked within the app.

- Comes with an easier and more cost-effective personal finance app development process

Benefits of Complex Finance Apps

This is the latest version of the personal finance app. Here, the bank card and accounts of the user are linked to the software which extracts the data for every transaction on its own.

- It is easy to use app that doesn’t ask the users to carry out not-so-important actions.

- The app is highly efficient as it doesn’t rely on the memory of the user.

What Are The Different Monetization Strategies Adopted By Personal Finance Apps?

You can earn profit for your finance app through different monetization methods. Some of them are :

Subscription

You can either offer a free to use an app or can make it paid through monthly/yearly subscriptions wherein the users need to pay for the subscriptions they select

Freemium

It is one of the effective monetization models for your budgeting app. It helps the users try a product before buying it. It means a user can download the app with standard features to try whether they like the app or not and later pay for added features.

Popular Personal Budgeting Apps To Watch Out For

- YNAB (You need a budget)

- GoodBudget

- Joy

- Acorns

- Mint

Tips To Build Robust Financial App

A financial app process needs to have added features. But, adding more features is not sufficient to gain more customers and increase their engagement. There are other things that you need to follow before you start with on-demand budget planner app development.

Security is important

Certainly, the job to build a fiancé app doesn’t end with designing or developing, but you need to make sure it offers high security. It will help you gain the trust of people wherein they know their confidential data is protected on your app.

What Should Financial Apps Have For Higher Security?

- Two-factor authentication

- Stored and transmitted data should be encrypted at the data channel. It can be a basic SSL protocol.

- Effective Session mode- offer short-term sessions to prevent situations that run unprotected.

Consider The Users' Point of View

Certainly, before you start with mobile application development services to get a robust finance app, make sure you step into the shoes of users to know the types of issues they encounter related to the management of their finances.

So, know your target audience and think from their point of view to build a finance app that meets their needs.

Keep It Simple

Try to avoid complex solutions so keep your finance apps easy to use and simple to gain customer loyalty.

Let the users get their desired job done through your app in as few as 3 clicks. Keep the payment options simple.

Innovative UX design

Yet another thumb rule you can follow during the white-label financial app developmentjourney is having an innovative and clean UX design. Do not make a cluttered UI/UX design that users may find confusing to use. You can seek consultation from tech experts to know the appropriate UX/UI design for your finance app to gain more customers.

Also, make sure the app design can be changed to meet the latest trends of UI/UX.

Round The Clock Customer Support

Certainly, your users may face issues while using the app, so make sure they can access customer support instantly. Also, your customer support team should respond as fast as they can. Also, make sure your app is created to offer round the clock customer assistance

Compatible With iOS And Android Platforms

Make sure your finance app should be compatible with both Android and iOS platforms so that you do not miss out on customers using Apple and Android devices.

Go With The MVP Model First

In case you are short of budget to build your finance app, then make sure you create the MVP model of your app.

What Are The Trends In Personal Finance App Development?

- Voice commands are essential for personal accounting apps as users find it fast and convenient to voice the spending rather than typing them

- AI-based algorithms can help make the most of the latest technological advancements. AI helps assess spending patterns and suggests tips to make them better.

- Gamification features added to the app help users connect with your app. It makes the app more engaging for the users

- Help the users add expenses on the first screen of your app. It helps you make the app gain popularity

- Help users understand the idea of budgeting. Integrate unique ideas to help users reduce expenses and save money.

Step By Step Guide App Development Process

The process to build a budget app is not much different than creating any other app. Here are the steps you can follow to build a successful finance app

- Focus on market research & analytics

- Plan a smooth development process

- Pay attention to Security

- App design

- Testing & launching

Summary

After reading about the benefits of creating a finance management app, if you want to sail through a successful development process, then hire an expert mobile app development agency with relevant experience in building finance apps.

Well, The Q Dev can be your trust app development partner with vast experience in building personal finance apps that deliver desired results.

Our team of skilled app developers will help you implement your app idea using the best development practices and functionalities. Get in touch with us to share your app requirements and get a free quote to know about personal finance app development costsfor your appproject.